All Categories

Featured

Table of Contents

Making use of the above example, when you obtain that same $5,000 loan, you'll make returns on the whole $100,000. It's still fully moneyed in the eyes of the common life insurance policy company. For infinite financial, non-direct acknowledgment policy financings are suitable. Last but not least, it's important that your policy is a blended, over-funded, and high-cash value policy.

Riders are additional functions and benefits that can be added to your plan for your particular demands. They allow the policyholder acquisition a lot more insurance or transform the conditions of future purchases. One reason you may wish to do this is to get ready for unanticipated illness as you obtain older.

If you include an added $10,000 or $20,000 upfront, you'll have that cash to the financial institution from the start. These are just some actions to take and take into consideration when establishing your way of living banking system. There are numerous different methods which you can take advantage of way of life financial, and we can help you locate te best for you.

Infinite Banking Explained

When it comes to monetary planning, entire life insurance typically stands out as a popular choice. While the idea might appear appealing, it's critical to dig deeper to comprehend what this actually suggests and why checking out whole life insurance coverage in this means can be deceptive.

The concept of "being your own bank" is appealing because it recommends a high level of control over your funds. This control can be illusory. Insurer have the ultimate say in how your plan is taken care of, including the terms of the financings and the prices of return on your cash worth.

If you're considering whole life insurance policy, it's vital to watch it in a wider context. Entire life insurance policy can be a useful tool for estate preparation, giving an assured survivor benefit to your recipients and possibly using tax obligation benefits. It can additionally be a forced savings vehicle for those who have a hard time to conserve money consistently.

It's a form of insurance policy with a savings element. While it can use steady, low-risk development of cash worth, the returns are typically less than what you might accomplish through various other financial investment cars. Before delving into entire life insurance policy with the concept of infinite financial in mind, put in the time to consider your financial goals, danger tolerance, and the full variety of economic items available to you.

Boundless financial is not a financial panacea. While it can function in particular situations, it's not without dangers, and it requires a considerable dedication and comprehending to take care of efficiently. By recognizing the potential risks and recognizing the real nature of whole life insurance policy, you'll be better geared up to make an informed choice that supports your economic wellness.

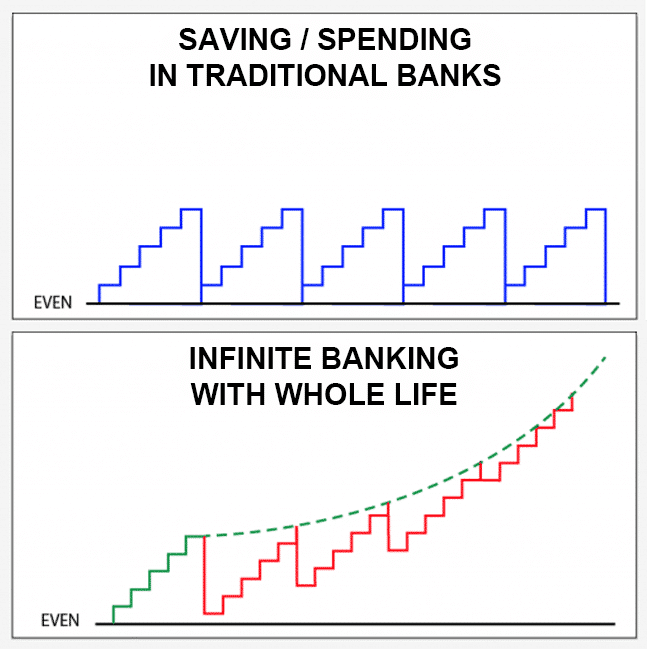

Rather of paying financial institutions for things we require, like automobiles, homes, and college, we can spend in means to maintain more of our cash for ourselves. Infinite Banking strategy takes a cutting edge method toward personal money. The strategy basically entails becoming your own bank by using a dividend-paying entire life insurance policy plan as your bank.

Bioshock Infinite Bank Of The Prophet Infusion

It gives considerable growth over time, transforming the basic life insurance plan right into a tough monetary device. While life insurance policy firms and banks risk with the change of the marketplace, the negates these risks. Leveraging a money worth life insurance policy plan, individuals delight in the benefits of assured growth and a fatality advantage secured from market volatility.

The Infinite Financial Principle shows just how much riches is permanently moved far from your Household or Organization. Nelson likewise goes on to describe that "you finance every little thing you buyyou either pay interest to somebody else or give up the interest you can have otherwise gained". The real power of The Infinite Banking Concept is that it fixes for this issue and encourages the Canadians who embrace this concept to take the control back over their funding needs, and to have that money receding to them versus away.

This is called shed opportunity cost. When you pay money for things, you permanently surrender the possibility to make interest by yourself financial savings over numerous generations. To fix this issue, Nelson developed his very own financial system via using returns paying participating whole life insurance policy plans, preferably through a shared life business.

Because of this, policyholders should thoroughly examine their monetary goals and timelines prior to choosing for this strategy. Sign up for our Infinite Banking Program. Recapture the interest that you pay to banks and financing companies for the major products that you require throughout a lifetime. Build and maintain your Personal/ Organization wide range without Bay Road or Wall Surface Street.

Infinite Banking Videos

Keep in mind, The boundless Banking Principle is a procedure and it can substantially boost every little thing that you are currently carrying out in your present economic life. Just how to get UNINTERRUPTED worsening on the routine payments you make to your financial savings, reserve, and pension How to position your hard-earned money so that you will certainly never have another sleepless evening fretted about how the markets are mosting likely to respond to the next unfiltered Governmental TWEET or worldwide pandemic that your household merely can not recuperate from Just how to pay yourself initially using the core principles instructed by Nelson Nash and win at the money video game in your own life Just how you can from 3rd event financial institutions and loan providers and relocate it into your very own system under your control A structured means to make certain you pass on your wealth the means you desire on a tax-free basis Exactly how you can move your money from for life taxed accounts and shift them right into Never tired accounts: Hear exactly how individuals simply like you can apply this system in their own lives and the effect of putting it into action! That producing your own "Infinite Financial System" or "Wide range System" is potentially one of the most remarkable approach to store and shield your cash money circulation in the nation How executing The Infinite Banking Refine can produce a generation causal sequence and educate real stewardship of cash for numerous generations How to be in the chauffeur's seat of your financial fate and lastly produce that is safeguarded and only goes one directionUP! The duration for developing and making substantial gains via unlimited financial greatly relies on numerous aspects distinct to a person's monetary placement and the plans of the monetary establishment providing the service.

Additionally, a yearly returns repayment is one more substantial benefit of Limitless banking, more highlighting its good looks to those geared in the direction of long-term financial growth. This strategy requires mindful factor to consider of life insurance coverage prices and the analysis of life insurance coverage quotes. It's important to analyze your credit rating report and challenge any type of existing charge card financial debt to guarantee that you are in a beneficial setting to embrace the approach.

A crucial facet of this technique is that there is insensitivity to market fluctuations, due to the nature of the non-direct recognition finances utilized. Unlike investments connected to the volatility of the markets, the returns in limitless banking are stable and foreseeable. Additional money over and over the costs settlements can also be added to speed up development.

Infinite Banking Forum

Insurance holders make regular costs repayments into their participating entire life insurance plan to keep it active and to construct the policy's overall cash money value. These exceptional payments are typically structured to be regular and foreseeable, ensuring that the plan remains energetic and the cash money value remains to grow gradually.

The life insurance policy plan is created to cover the entire life of a specific, and not just to assist their beneficiaries when the specific dies. That stated, the plan is getting involved, meaning the policy proprietor ends up being a component owner of the life insurance policy business, and takes part in the divisible earnings produced in the form of returns.

"Here comes Income Canada". That is not the case. When dividends are chunked back into the policy to purchase paid up additions for no extra cost, there is no taxable event. And each paid up enhancement likewise obtains returns every solitary year they're proclaimed. Currently you might have listened to that "rewards are not assured".

Table of Contents

Latest Posts

Universal Bank Unlimited Check

How Does Bank On Yourself Work

Banking With Life

More

Latest Posts

Universal Bank Unlimited Check

How Does Bank On Yourself Work

Banking With Life